Enterprise Report - Adjustments Log .ng

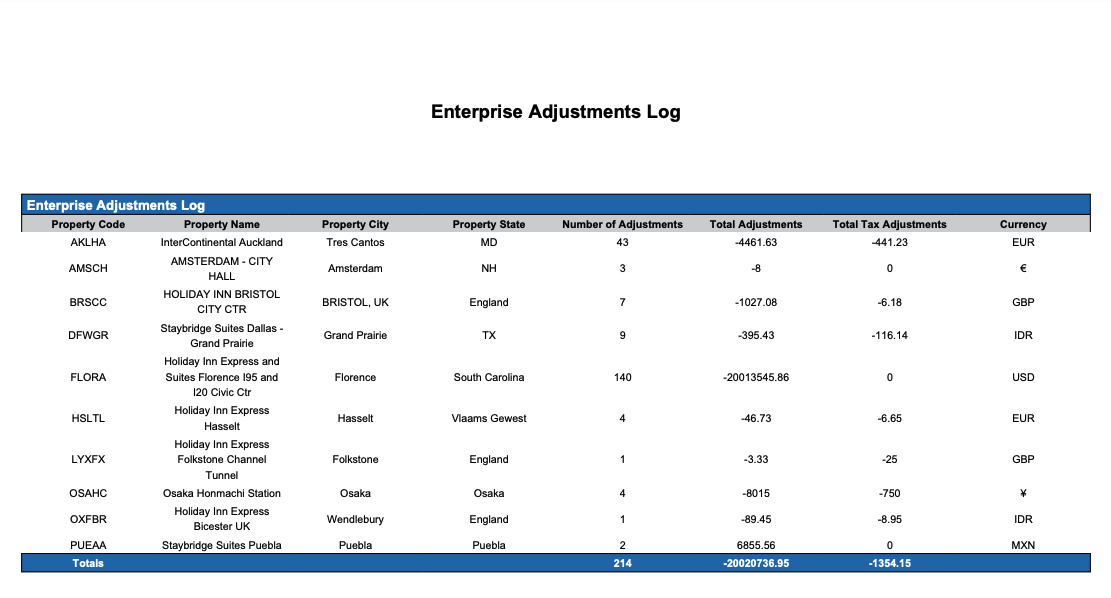

Enterprise Adjustments Log Report

Report Description: The Enterprise Adjustments Log report offers a comprehensive list of rate adjustments and refunds transactions made within a specified period, showcasing transaction details such as date, time, type, number, reason code, amount, and user information, facilitating financial tracking and transaction reconciliation.

Date Range: This report can render the historical data for the last 90 days to date

Summary section: Provides an overview of adjustments by property. Selecting any one of the properties mentioned opens detailed logs of adjustments.

Available Report Columns for Following Section:

Column Name | Column Description | Amount Includes Taxes and Fees | Calculation |

Property Code | Hotel code | Not Applicable | Not Applicable |

Property Name | Name of the hotel | Not Applicable | Not Applicable |

Property City | City the property is located and operating | Not Applicable | Not Applicable |

Property State | State the property is located and operating | Not Applicable | Not Applicable |

Number of Adjustments | Number of adjustments made in the timeline selected | Not Applicable | Not Applicable |

Total Adjustments | Total amounts adjusted in the timeline selected | Not Applicable | Not Applicable |

Total Tax Adjustments | Total tax amounts adjusted in the timeline selected | Not Applicable | Not Applicable |

Currency | Local currency used on the property | Not Applicable | Not Applicable |

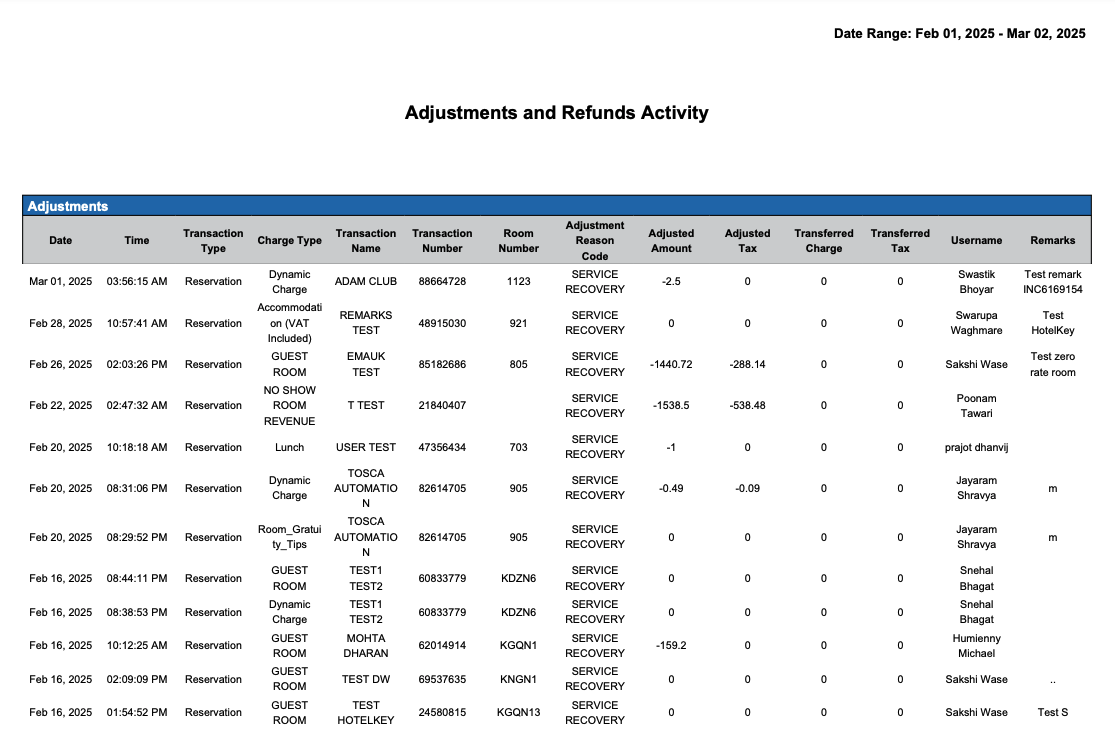

Adjustments section: The adjustments section provides a detailed list of rate adjustments by transaction number and user.

Available Report Columns for Following Sections:

Column Name | Column Description | Amount Includes Taxes and Fees | Calculation |

Date | Date of the transaction (ex - March 25, 2024) | Not Applicable | Not Applicable |

Time | Time of the transaction (ex - 05:39:49 AM) | Not Applicable | Not Applicable |

Transaction Type | Type of transaction (ex - Reservation, House Account, etc.) | Not Applicable | Not Applicable |

Charge Type | Used to sort transactions involving income, different types of expenses, equipment purchases, etc. | Not Applicable | Not Applicable |

Transaction Name | Name of the account the transaction is being made on; ie, House Account, Guest Room, etc | Not Applicable | Not Applicable |

Transaction Number | Unique identifier for the adjustment transaction | Not Applicable | Not Applicable |

Room Number | Identifier of the room associated with the transaction | Not Applicable | Not Applicable |

Adjustment Reason Code | Code representing the reason for the adjustment | Not Applicable | Not Applicable |

Adjusted Amount | Amount adjusted in the transaction | NO | =sum(adjusted) |

Adjusted Tax | Tax amount adjusted in the transaction | NO | =sum(adjusted tax) |

Transferred Charge | Charges that were transferred to a folio outside the reservation, House Account, Group Master, etc. | NO | Not Applicable |

Transferred Tax | Taxes that were transferred to a folio outside the reservation, House Account, Group Master, etc. | YES | =sum(transferred tax) |

Username | Username that processed that transaction | Not Applicable | Not Applicable |

Remarks | Additional remarks regarding the adjustment | Not Applicable | Not Applicable |

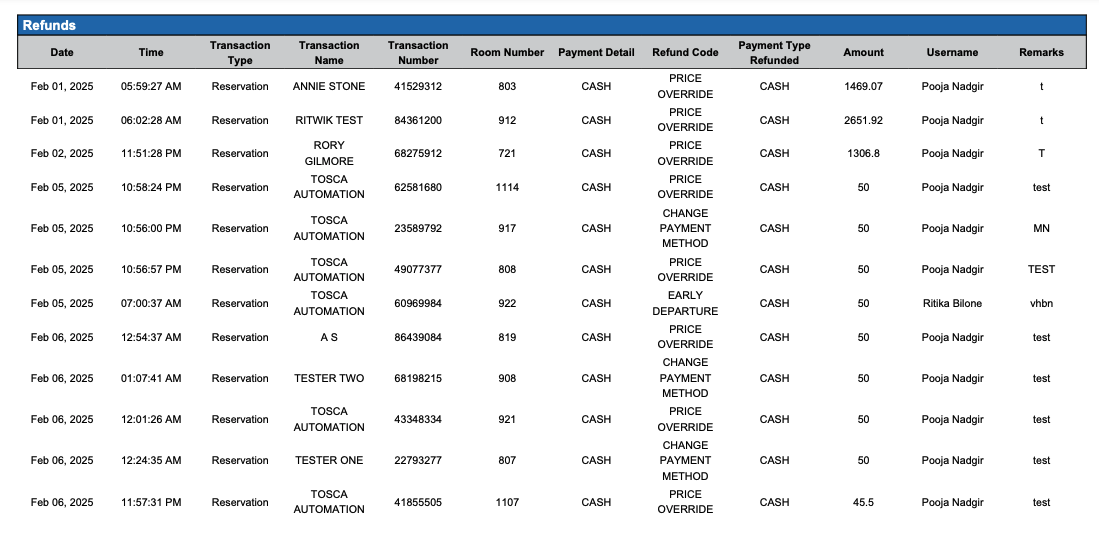

Refunds section: The Refunds section provides a detailed list of payment refunds by transaction number and user.

Available Report Columns for Following Sections:

Column Name | Column Description | Amount Includes Taxes and Fees | Calculation |

Date | Date of the transaction (ex - March 25, 2024) | Not Applicable | Not Applicable |

Time | Time of the transaction (ex - 05:39:49 AM) | Not Applicable | Not Applicable |

Transaction Type | Type of transaction (ex - Reservation, House Account, etc.) | Not Applicable | Not Applicable |

Transaction Name | Name of the account the transaction is being made on; ie, House Account, Guest Room, etc | Not Applicable | Not Applicable |

Transaction Number | Unique identifier for the adjustment transaction | Not Applicable | Not Applicable |

Room Number | Identifier of the room associated with the transaction | Not Applicable | Not Applicable |

Payment Detail | Shows method of payment (cash, credit card, direct bill, etc) | Not Applicable | Not Applicable |

Refund Code | Code representing the reason for the refund | Not Applicable | Not Applicable |

Payment Type Refunded | Payment type used for the refund | Not Applicable | Not Applicable |

Amount | Amount refunded in the transaction | YES | Not Applicable |

Username | Username that processed that transaction | Not Applicable | Not Applicable |

Remarks | Additional remarks regarding the adjustment | Not Applicable | Not Applicable |

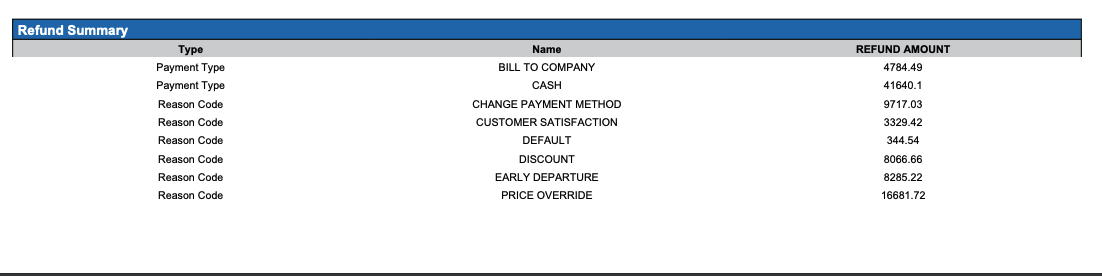

Refund Summary section: The Refund Summary section provides a total refund amount for the defined period by type.

Available Report Columns for Following Sections:

Column Name | Column Description | Amount Includes Taxes and Fees | Calculation |

Type | Type of refund (example: Payment Type, Reason Code, etc. | Not Applicable | Not Applicable |

Name | The name of the type | Not Applicable | Not Applicable |

Refund Amount | Total amount refunded for the defined period by type | Not Applicable | =sum(Refund Amount) |

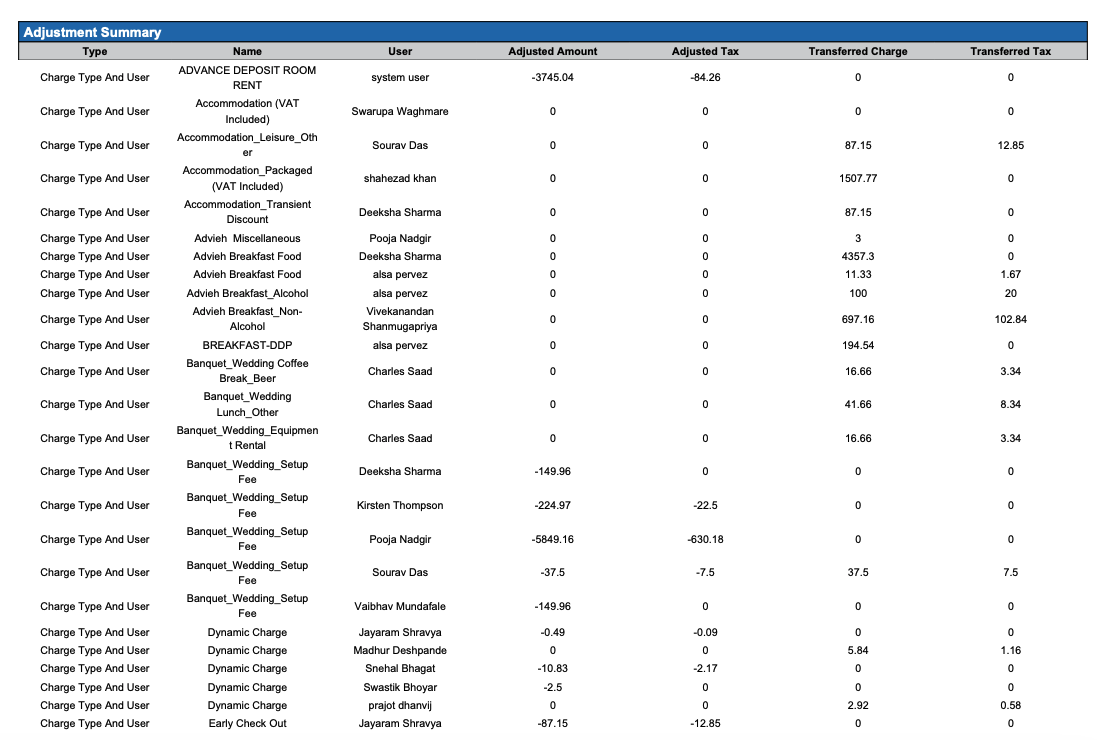

Adjustment Summary section: The Adjustment Summary section provides a total adjusted amount for the defined period by type.

Available Report Columns for Following Sections:

Column Name | Column Description | Amount Includes Taxes and Fees | Calculation |

Type | Type of adjustment (example: charge type, reason code, etc.) | Not Applicable | Not Applicable |

Name | The name of the type | Not Applicable | Not Applicable |

User | The user ID who made the adjustment | Not Applicable | Not Applicable |

Adjusted Amount | Total amount adjusted for the defined period by type | NO | =sum(Adjusted Amount) |

Adjusted Tax | Total tax amount adjusted in the transaction | YES | =sum(Adjusted Tax) |

Transferred Charge | Room Revenue charges that were transferred to a folio outside the reservation, typically to a House Account. | NO | =sum(Transferred Charge) |

Transferred Tax | Taxes that were transferred to a folio outside the reservation, typically to a House Account. | NO | =sum(Transferred Tax) |

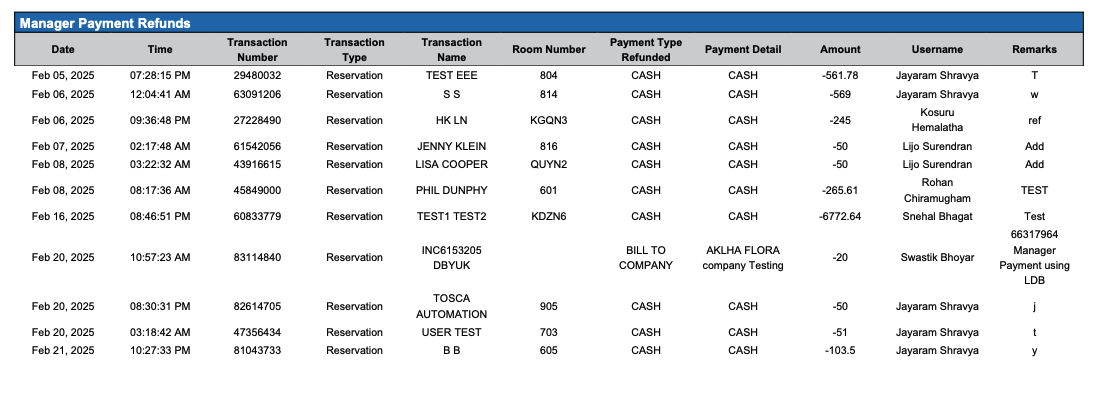

Manager Payment Refunds section: The Manager Payment Refunds section provides a total adjusted amount for the defined period by type.

Available Report Columns for Following Sections:

Column Name | Column Description | Amount Includes Taxes and Fees | Calculation |

Date | Date of the transaction (ex - March 25, 2024) | Not Applicable | Not Applicable |

Time | Time of the transaction (ex - 05:39:49 AM) | Not Applicable | Not Applicable |

Transaction Number | Unique identifier for the adjustment transaction | Not Applicable | Not Applicable |

Transaction Type | Type of transaction (ex - Reservation, House Account, etc.) | Not Applicable | Not Applicable |

Transaction Name | Name of the account the transaction is being made on; ie, House Account, Guest Room, etc | Not Applicable | Not Applicable |

Room Number | Identifier of the room associated with the transaction | Not Applicable | Not Applicable |

Payment Type Refunded | Payment type used for the refund | Not Applicable | Not Applicable |

Payment Detail | Shows method of payment (cash, credit card, direct bill, etc) | Not Applicable | Not Applicable |

Amount | Amount refunded in the transaction | YES | Not Applicable |

Username | Username that processed that transaction | Not Applicable | Not Applicable |

Remarks | Additional remarks regarding the adjustment | Not Applicable | Not Applicable |

Misc Report Information:

Available Features:

Export: ability to download and save the file into an alternate format.

Filter: filter a range of data based on criteria defined by the user.

Highlight: also known as conditional formatting is the ability to highlight certain values making them easier to identify.

Bar Chart: ability to display data in a bar chart view.

Group By: ability to group data All, Transaction Code, Transaction Description or Transaction Type

Available Configuration:

User Preferences: allows the user to customize their report view by repositioning or removing columns.

Property Preferences: allows the property to customize the report view for all users by repositioning or removing columns.