Apply Tax Exempt Status to Reservation

📆 Revision Date:

It is important to note that you can add tax exemption on an In House reservation or on an arrivals reservation, steps are the same. This scenario walks through an in house reservation.

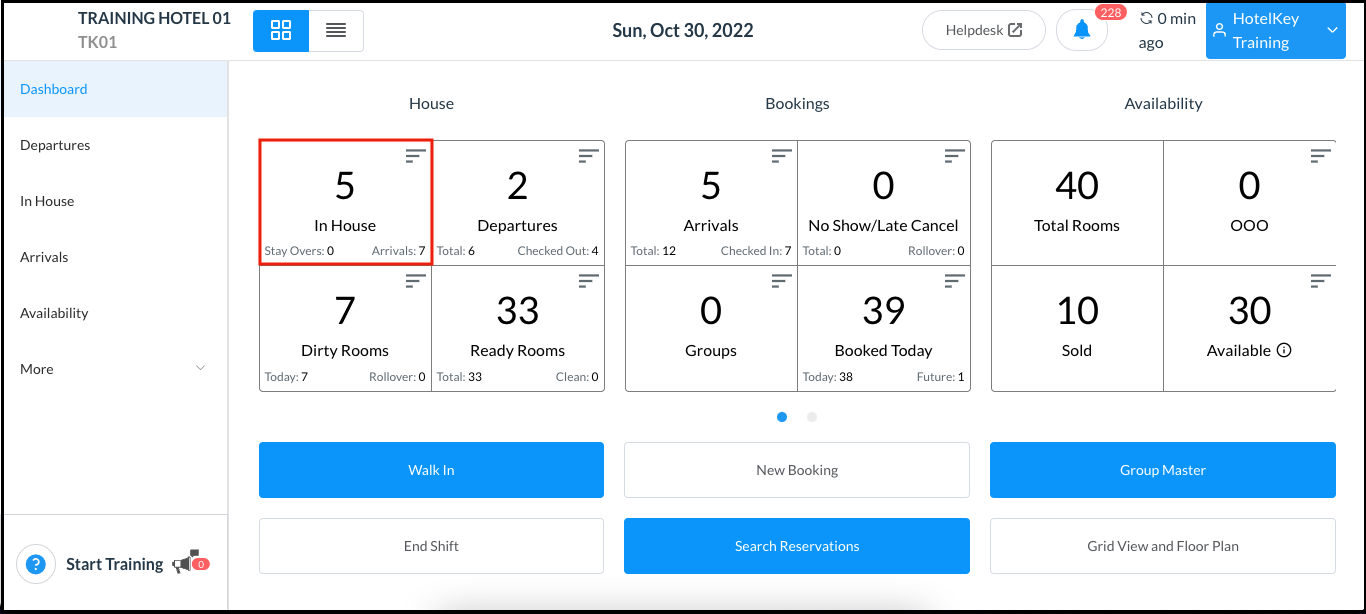

Select In House on the Dashboard. For a future booking, select Search Reservations to locate the booking Note - You can add tax exemption on an In House reservation or on an arrivals reservation, steps are the same |  Dashboard - In House Link |

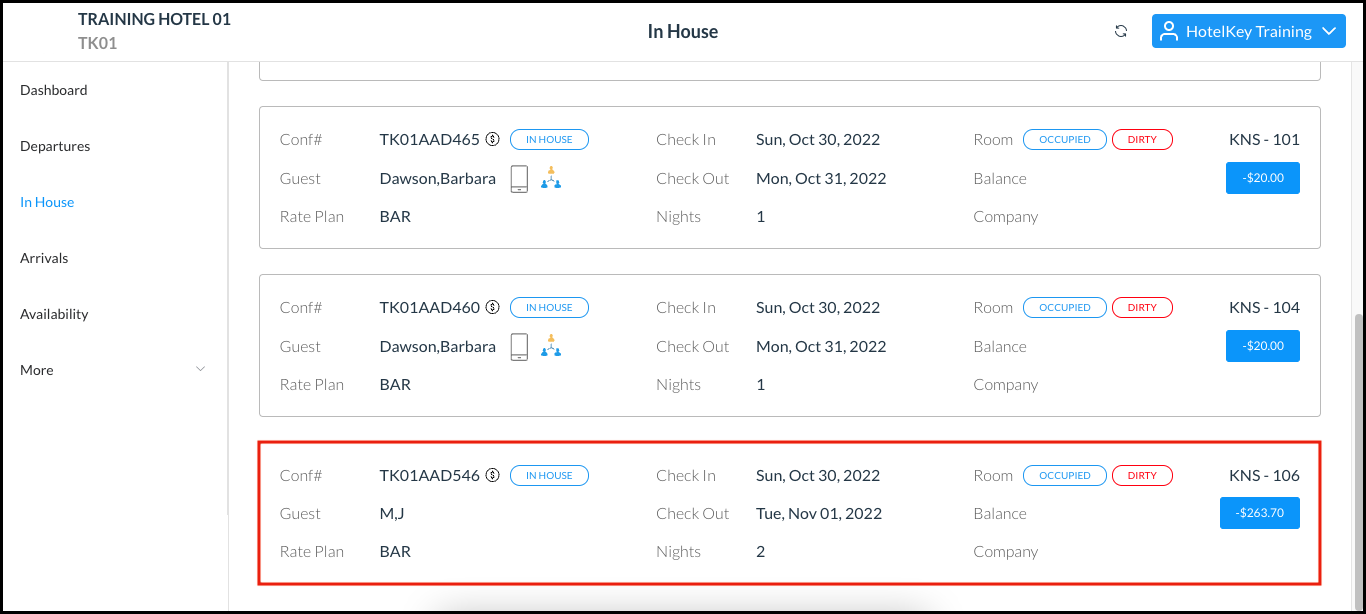

A page listing in house reservations loads. Select the applicable reservation. |  In House Reservations Page |

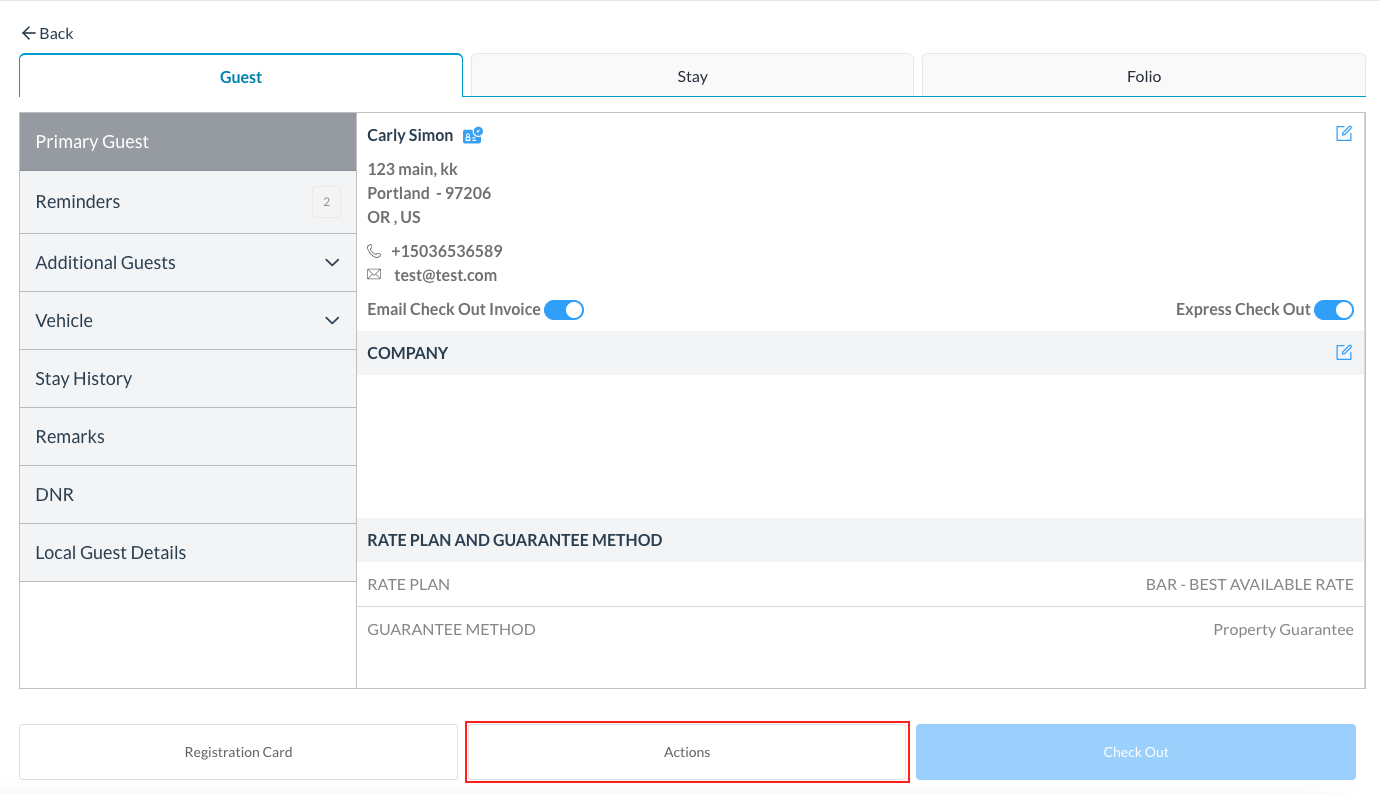

The reservation detail page loads. Select Actions. |  |

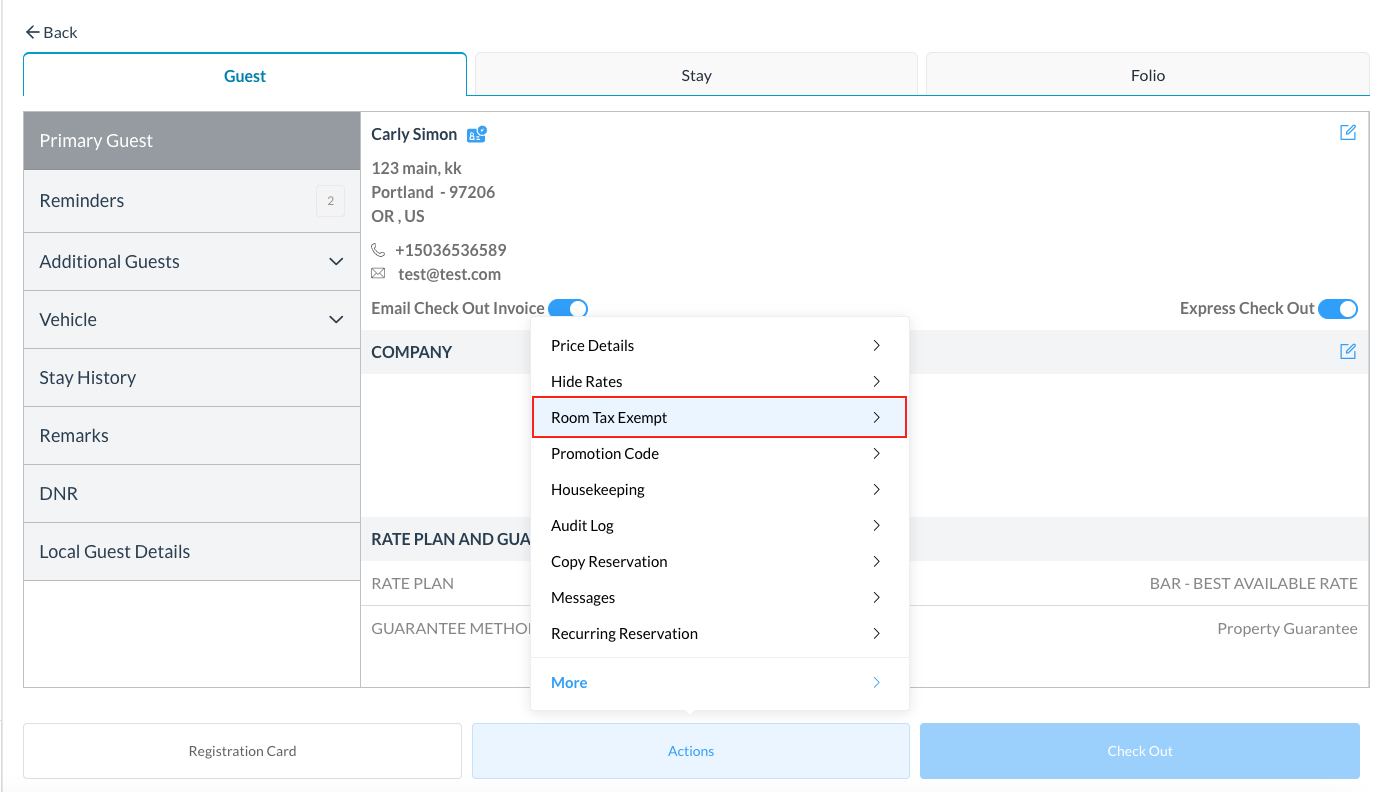

The Actions menu opens. Select “Room Tax-Exempt”. |  |

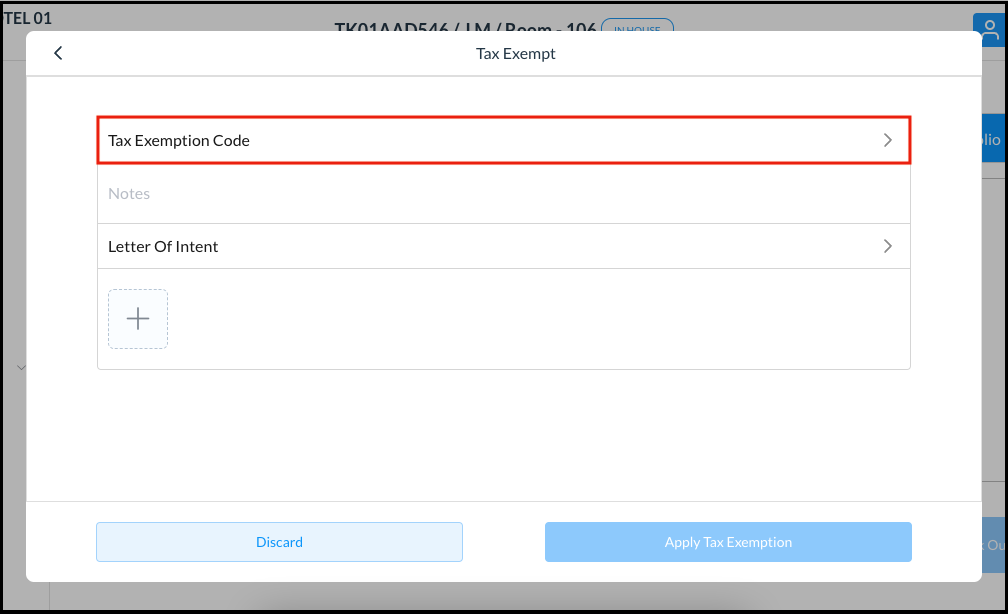

The Tax Exempt popup activates. Select Tax Exemption Code. |  Tax Exempt Popup |

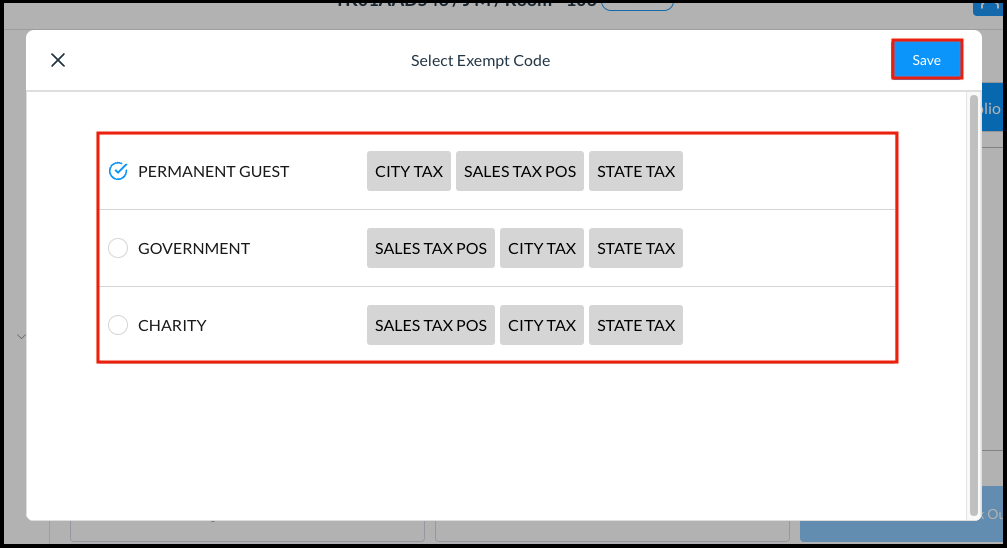

The Select Exempt Code popup activates. Taxes being exempted are listed for each tax exemption code. Select the applicable tax exemption code. |  Select Exempt Code Popup |

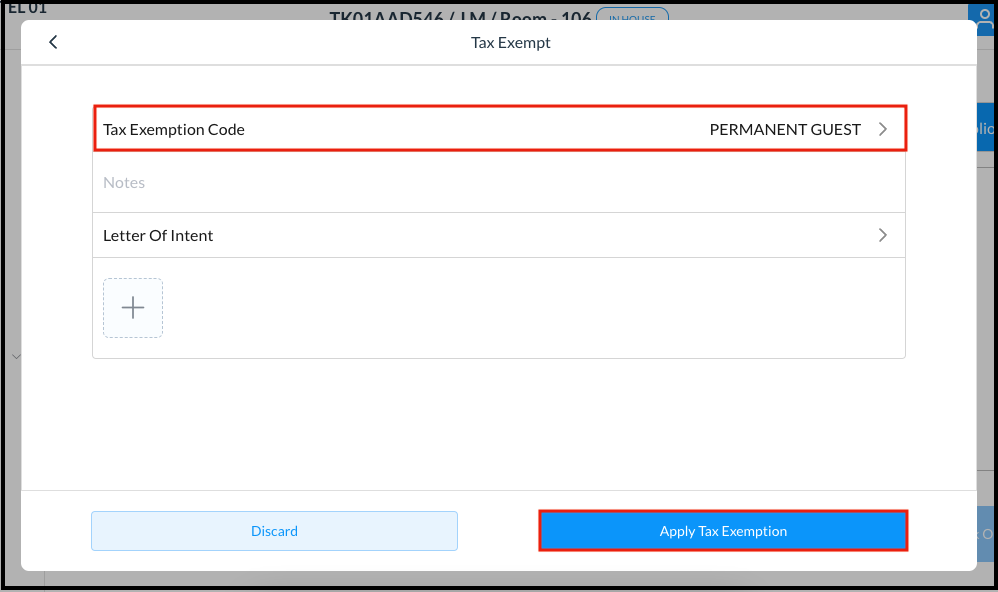

The Select Exempt Code popup closes. Back on the Tax Exempt popup, optionally enter Notes. Select Apply Tax Exemption to save selections and close the popup. |  Tax Exempt Popup - Apply Tax Exemption Link |

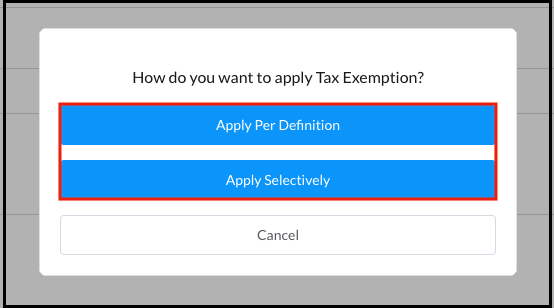

The How do you want to apply Tax Exemption? popup activates.

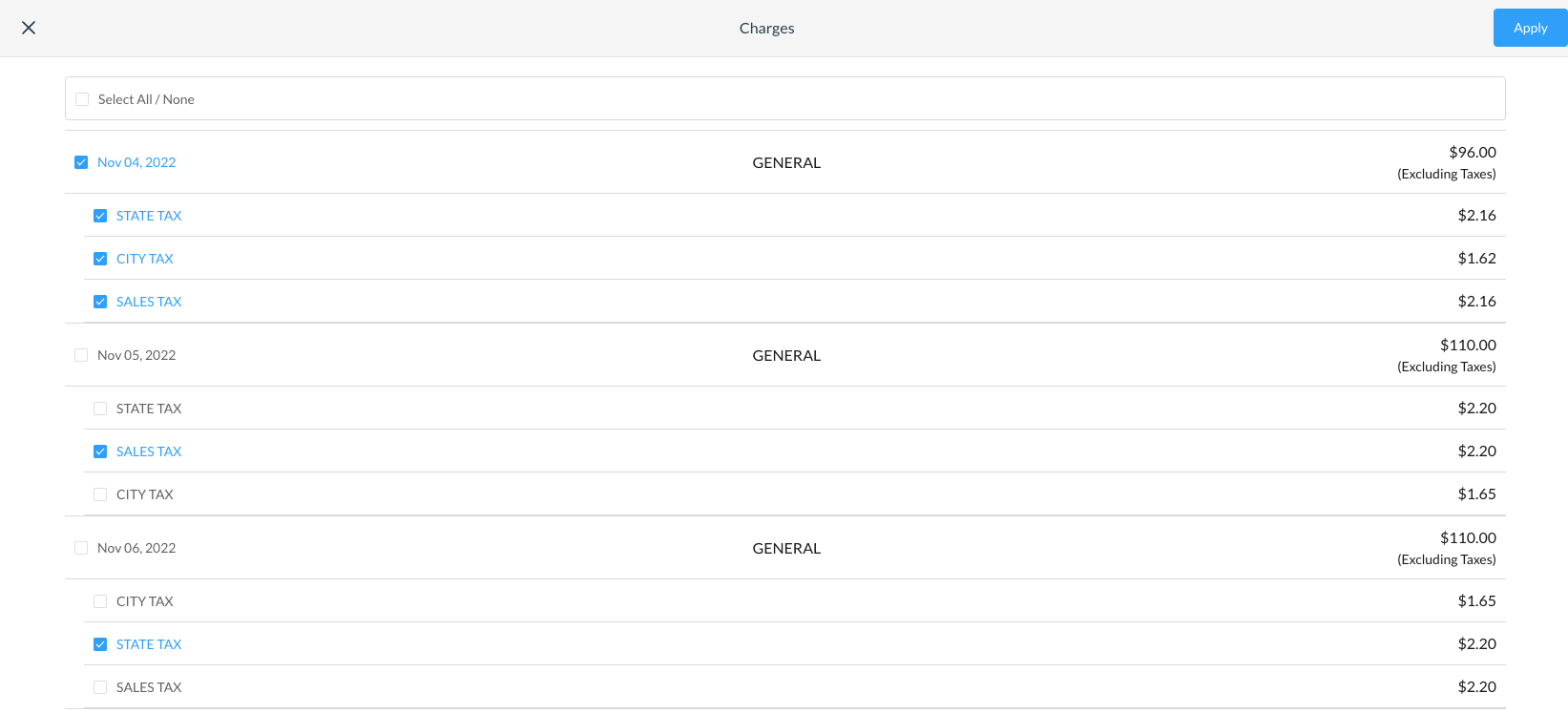

For example, in the Select Exempt Code popup shown above the PERMANENT GUEST exemption type is configured to exempt “CITY TAX”, “STATE TAX” and “SALES TAX”. Select Apply Per Definition to exempt all of those taxes per the configuration, select Apply Selectively to open a form that allows individual de-selection of any or all three of those exemptions for this reservation only. see image on right |  How do you want to apply Tax Exemption? Popup  Example of selective taxes |

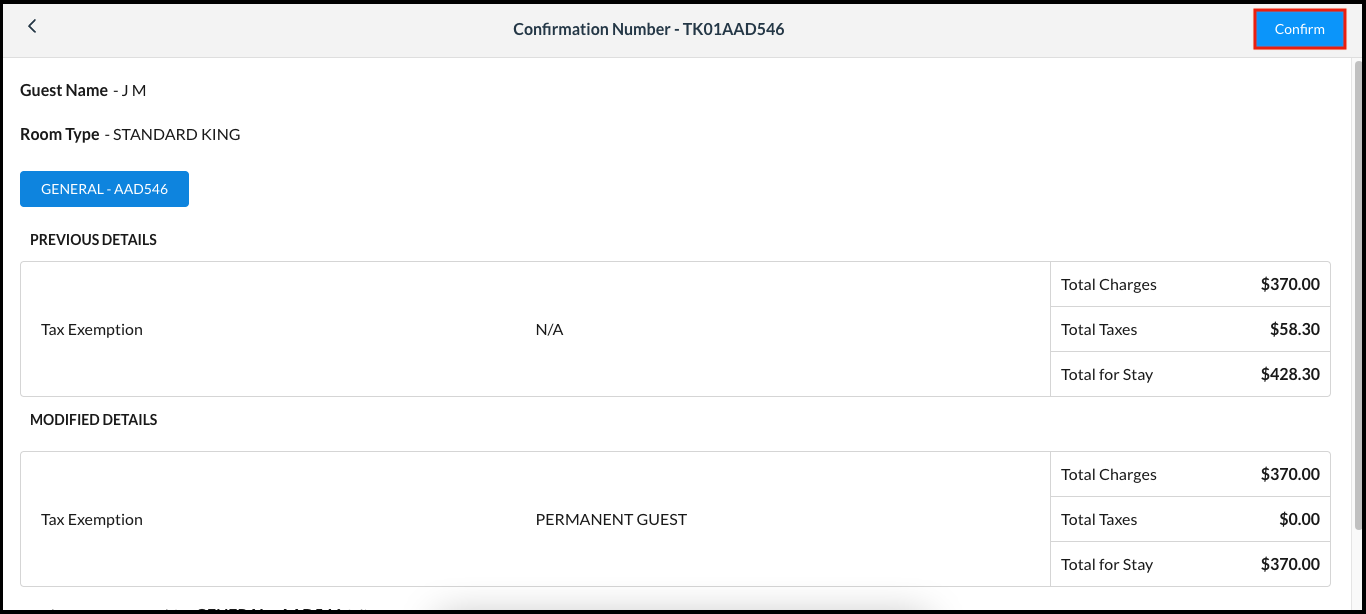

A Confirmation page loads. Select Confirm to close the Confirmation page and apply the tax exemption to the selected reservation. |  Confirm Changes Popup |